AbbVie’s ABBV second-quarter revenues are likely to be driven by product revenues generated from its newer immunology drugs, Rinvoq and Skyrizi.

Around half of the company’s revenues is expected to be generated from its immunology franchise, consisting of three blockbuster drugs — Humira, Rinvoq and Skyrizi. Humira, which is also the company’s flagship product, recently lost exclusivity in the United States following the launch of Amgen’s Amjevita in first-quarter 2023, the first U.S. biosimilar to the drug. Sales of the drug have been declining in the United States since the first quarter.

This month, at least five companies — Boehringer Ingelheim, Samsung Bioepis, Biocon, Coherus BioSciences and Novartis (through its Sandoz generic arm) — have also launched their own Humira biosimilars. More biosimilars are expected to be launched throughout this year. These subsequent launches are further expected to erode Humira’s sales in subsequent quarters. The drug has already lost the exclusivity in ex-U.S. territories following the launch of generics in 2018.

The Zacks Consensus Estimate and our model estimate for Humira’s sales during the second quarter are pegged at $3.93 billion and $3.95 billion, respectively.

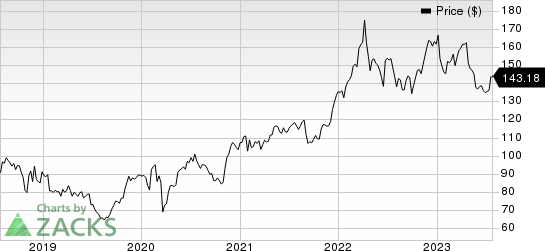

AbbVie’s stock has lost 11.4% in the year so far against the industry‘s 3.3% growth.

Image Source: Zacks Investment Research

To make up for the falling Humira sales, AbbVie is focused on launching its newer immunology drugs — Skyrizi and Rinvoq — across Humira's major indications and a distinct new indication, atopic dermatitis. Since launch, drugs have established outstanding launch trajectories and demonstrated robust sequential revenue growth — a trend that we expect to continue in the to-be-reported quarter.

During the quarter under review, Rinvoq received label expansion approvals in Crohn’s disease indication in the United States and European Union. The Zacks Consensus Estimate and our model estimates for Rinvoq’s sales are pegged at $896 million and $878 million, respectively.

The Zacks Consensus Estimate and our model estimates for Skyrizi’s sales are pegged at $1.77 billion and $1.76 billion, respectively.

Sales of the company’s neuroscience franchise are expected to have been driven by new migraine drugs, Qulipta and Ubrelvy. The Zacks Consensus Estimate for the neuroscience franchise is pegged at $1.82 billion, while our estimates for the franchise are pegged at $1.78 billion.

In the aesthetics franchise, we expect overall sales to continue to be hurt by economic pressure impacting consumers' discretionary spending. AbbVie’s suspension of its aesthetics business operations in Russia has affected its sales, as Russia is a key market for fillers. The Zacks Consensus Estimate and our model estimate for aesthetics product sales stand at $1.33 billion and $1.32 billion, respectively.

U.S. sales growth of key oncology medicine, Imbruvica — developed in partnership with J&J JNJ — is being hurt by increased competition from novel oral therapies. Per J&J’s second-quarter earnings, Imbruvica sales declined 13.2%. For the J&J-partnered drug, the Zacks Consensus Estimate and our model estimates are pegged at $875 million and $884 million, respectively.

We expect the sales of another oncology drug, Venclexta — developed in collaboration with Roche RHHBY — are likely to rise as new patient starts are expected to improve. The Zacks Consensus Estimate and our model estimates for the Roche-partnered drug are pegged at $556 million.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank & Stock to Consider

AbbVie currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Werewolf Therapeutics HOWL, which carries a Zacks Rank #2 (Buy). You can the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Werewolf Therapeutics’ 2023 loss per share have narrowed from $1.42 to $1.29. During the same period, the loss estimates per share for 2024 have improved from $1.81 to $1.37. Year to date, shares of HOWL have surged 86.3%.

Earnings of Werewolf Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion, registering an earnings surprise of 5.29% on average. In the last reported quarter, HOWL’s earnings beat estimates by 30.61%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Werewolf Therapeutics, Inc. (HOWL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"make up" - Google News

July 25, 2023 at 09:48PM

https://ift.tt/2UrMn36

Will AbbVie's (ABBV) New Drugs Make Up for Low Humira Sales? - Yahoo Finance

"make up" - Google News

https://ift.tt/U0jmvqY

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Will AbbVie's (ABBV) New Drugs Make Up for Low Humira Sales? - Yahoo Finance"

Post a Comment